Entry #11 — PGS’s first vendor inventory payment is due of $1,000. Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.

General Journal Examples – Entries format with Calculations

This is why the general ledger is also called the original book of entries, chronological book, or daybook. In the journal, two aspects of every transaction are recorded, following the double-entry system of accounting. With a combination journal, only the total amounts of each column are posted in the general ledger, thus saving a lot of time and effort. The entries in the sundry column can be posted individually to the general ledger. Journalizing or Booking is the process of recording business transactions in the journal.

How much will you need each month during retirement?

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

One represents the income side and one represents the expenditures side. A ledger is an account of final entry, a master account that summarizes the transactions in the Company. It has individual accounts that record assets, liabilities, equity, revenue, expenses, maximizing your section 179 deduction in 2021 gains, and losses. An entry in the journal would be made whereby the cash account is decreased by $ 5000, and the inventory account is increased by $ 5000. All other transactions not entered in a specialty journal account for in a General Journal.

Learn At Your Own Pace With Our Free Courses

- However, these journals were more visible in the manual record-keeping days.

- This process helps in preparing the trial balance, income statement, and balance sheet.

- In this article, we will discuss what a general journal is and show some general journal entries examples.

- This practice allows for the identification of discrepancies and ensures compliance with accounting standards.

- The process of recording transactions in the journal is referred to as journalizing.

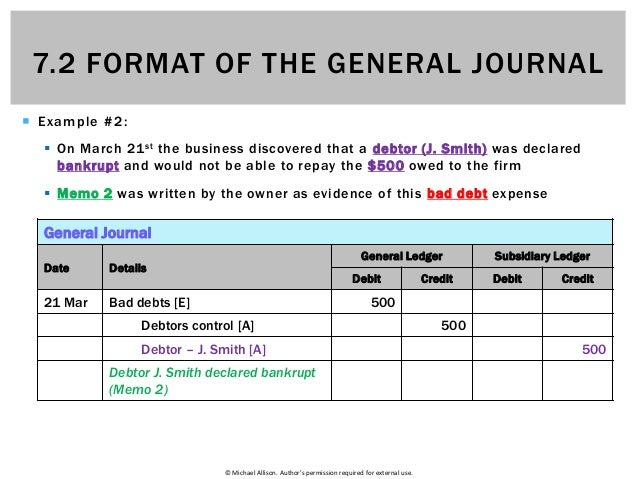

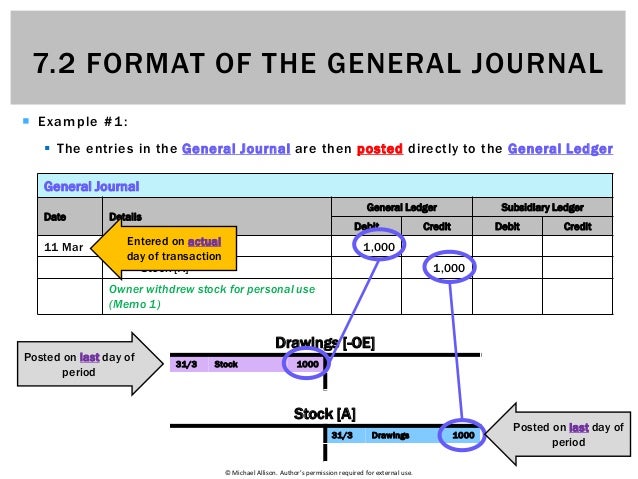

A Journal Entry is a formal method of recording transactions using debits and credits. The recording of journal entries needs to follow the debit and credit roles. For example, expenses are increasing in debit, and revenues are increasing in credit. In the detail of the journal, key information that should be included is a line of the journal, date of the transactions, name of the account, and description of transactions. Additional information that should include is a reference and, more importantly, is debit and credit.

Each business transaction is analyzed for the economic impact on the asset, liability, and equity accounts before being recorded in the accounting system with a journal entry. Since every single business transaction is recorded or journalized throughout the year, there are tons of different journal entries. Most journal entries are recorded in general journal, but specific journal entries like credit sales of inventory are recorded in separate journals like the sales journal.

The description column on the general journal is used to enter the names of the accounts involved in the transaction. The general journal transaction entries always begin with a statement of the date that the transaction took place. The year, month, and date of a transaction are written in the date column. The year is entered immediately below the Date heading and is written once per page (that is, you don’t have to be repeating the year for every entry on the page). At the end of the period, all of the entries in the general journal are tallied up in their corresponding accounts and are reported on the trial balance.

Likewise, there is also no journal entry required to be recorded when Mr. A hired an assistant photographer on March 6 since the employee has yet to render a service for the business. No form of compensation was also paid to require recording the transaction. In this example, any form of payroll and sales taxes will be disregarded to simplify recording of transactions. Below are the journal entries for each transaction during March 2023 and how they are recorded in the general journal.

The company received supplies thus we will record a debit to increase supplies. By the terms “on account”, it means that the amount has not yet been paid; and so, it is recorded as a liability of the company. First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment. Notice that on March 3, there are no journal entries recorded because there was no exchange of values between Mr. A and the lessor. No security deposit and advance rental payment was made by Mr. A to the lessor.